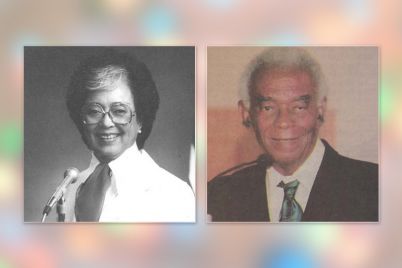

According to President and CEO of TBBBIC Albert Lee, the organization’s relationship with Raymond James Bank has allowed them to offer more extensive and sophisticated services.

TAMPA – The Tampa Bay Black Business Investment Corporation (TBBBIC) has deepened its partnership with Raymond James Bank to support local Black-owned businesses through increased funding and loans.

In addition to providing direct loans to TBBBIC to amplify the organization’s efforts, this enhanced partnership means Raymond James Bank will also provide larger-scale loans to support local Black-owned businesses. In fact, TBBBIC has $2,620,000 in approved loans, with a portion of those loans already closed with the new affiliation and will collaborate with other partners to further fuel the success of local Black entrepreneurs.

The funding component of the partnership allowed for TBBBIC to lend $350,000 to Community Development Corporation, CDC of Tampa, to acquire a key parcel of land in east Tampa that will serve as the linchpin to a significant community development project.

According to President and CEO of TBBBIC Albert Lee, the organization’s relationship with Raymond James Bank has allowed them to offer more extensive and sophisticated services. “We now have the ability to help clients in ways we previously weren’t able to – all without raising the cost to borrow.”

Chairman and CEO of Raymond James Bank Steve Raney echoed Lee’s sentiments. “This new arrangement is designed to make TBBBIC an increasingly sustainable, more broadly impactful organization. Their efforts, combined with the financial strength of Raymond James Bank, will allow us to make a resounding impact across our community.”

As for what inspired the elevated partnership, Raney explained that Raymond James Bank had spent three years supporting TBBBIC. “But after the heightened awareness of racial justice challenges in 2020, it was natural for us to join forces with them in a bigger way.”

Business owners interested in benefiting from this expanded partnership can begin by contacting TBBBIC, which will serve as their primary contact. As TBBBIC’s Senior Business Development Manager and Portfolio Manager, Brent Everett, explained, the organization analyzes projects on a case-by-case basis to determine if they are eligible to apply for a loan from TBBBIC or the new partnership program.

“From there, we’ll put together a comprehensive package for the bank and submit any necessary paperwork,” said Everett. I’ll then follow up with candidates with an expected time frame and other important details.”

While TBBBIC is advancing its mission of supporting small business owners in a time that’s been particularly trying for local establishments, its tradition of giving back traces back decades.

Founded in 1987 as a nonprofit, TBBBIC was created to serve businesses owned and operated by Black entrepreneurs and to provide loans to a historically underserved market segment of the community. Now a U.S. Treasury-certified Community Development Entity, TBBBIC assists entrepreneurs of all ethnic backgrounds.

The organization’s services range from underwriting and analyzing business and personal financial statements to delivering technical assistance. A testament to its efforts, TBBBIC spent the past year alone helping over 400 small businesses receive funding and navigate the grant process.

To learn more about the impact of TBBBIC, visit tampabaybbic.com. You can also reach TBBBIC’s Tampa office at 813-425-2043 or the St. Petersburg location at 727-826-5785.