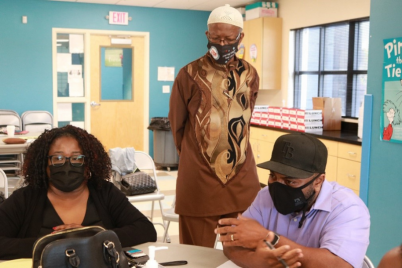

The April 25 Future of South St. Pete Economic Conference explored innovative economic strategies, sustainable urban development, and inclusive community engagement aimed at shaping south St. Pete. Brian Peret moderated the panel, which included Walter Smith, Erica Hardison, Keisha Edwards, Carl Lavender and Trevor Mallory.

BY FRANK DROUZAS | Staff Writer

ST. PETERSBURG — The Future of South St. Pete Economic Conference brought together a diverse mix of community stakeholders, including local entrepreneurs, community leaders and policymakers. The summit explored innovative economic strategies, sustainable urban development and inclusive community engagement aimed at shaping south St. Pete.

The Community Development and Training Center (CDAT) sponsored the April 25 conference at the Enoch Davis Center, which was moderated by CodeBoxx Academy Director Brian Peret.

Tamisha Darling Roberson, president and CEO of Pinellas County Association of Realtors, said homeownership is more than just a luxury for African Americans; it is a tangible reality and a catalyst for building generational wealth, stability, and pride.

Yet there is an affordable housing deficit, she noted, adding that though there are 90,000 African Americans in Pinellas County, only 500 mortgage applications came through. Of those applicants, 21 percent were denied mortgages, compared to the eight percent denial rate for whites.

Housing demand outpaces new home construction by 100,000 annually, and the income affordability rate is $90,000 per year, while the median income for Black households is between $52,800 and $60,000 per year —a sizeable gap.

Trevor Mallory is the president of Neighborhood Home Solutions (NHS), an organization that provides counseling and preparation for people seeking to become homeowners. He estimated that about 95 percent of its clients are African American.

NHS offers monthly classes, and after participants complete the program, they receive a certificate. The organization works to connect prospective homeowners with a lender for $200,000.

“They’re excited until they realize nothing in St. Pete will pass an inspection that you’re going to pay $200,000 for,” he said. “So, that’s a problem. My mission at Neighborhood Home Solution is to put ‘ability’ back into affordability.”

To accomplish it, it will have to start with legislation, Mallory said. People do not need new construction at this time, he explained, “they just need a place to call home,” adding that those who have been successfully renting for years shouldn’t have trouble securing mortgages.

Carl Lavender, chief equity officer for the City of St. Petersburg, said the city is currently on a “housing build spree,” trying to make affordable housing available to citizens at 80 percent below AMI (Area Median Income).

“We’re not getting that interpretation from lots of folks, but it is happening,” he said. “I can tell you from the inside out that it is happening as fast as one can build buildings.”

Lavender is encouraging organizations that create jobs or job readiness programs to start getting people ready to work in industries where they’re paying more money, such as the tech industries, which “are starving for more people of color to work in the industry, and we’re not getting the applicants as fast as the jobs are available.”

He also mentioned the construction industry. The Gas Plant redevelopment project will spread $6.5 billion locally over the next 20 years, and the cornerstone of the project will be the construction of new property per parcel.

“So where is that population in our county that can compete through an RFP to win the bid to do that kind of work,” asked Lavender.

Lavender said that per square mile on the south side of the city, there are far too many nonprofits employing people at the professional level and not enough corporations paying people competitive salaries.

Environmental expert Walter Smith said through gentrification, African Americans saw their communities being taken away from them. Homes built by whites for $500,000 in neighborhoods where $100,000 homes were the maximum denied Black people the ability to even buy in their own community, where residents’ average income frequently maxed out about $40,000 per year.

“We need money,” said Erica Hardison, board president of One Community Grocery Co-op. “We need money to buy a house. We need money to pay the utilities; we need money to spend throughout our communities, but when we don’t have that, it makes it very difficult. But what brings money to a community? Institutions and businesses. And where are those in our community? Where’s the grocery store? Where’s the bank? Where are the things that employ people to make money?”

She said restaurants and other service-based industries help circulate money in the community. Once that circulation occurs, the community will be in a better overall position.

“They say the average dollar in the Black community lasts six hours,” informed Hardison. “One of the reasons it lasts six hours is because where are we going to spend it at in our community? Where’s the grocery store? Where’s the clothing store? Where are you going to buy sneakers?”

On the issue of health equity, when a neighborhood has only convenience stores rather than proper grocery stores, the residents’ health suffers.

Hardison praised the St. Petersburg Parks and Recreation department for its Fresh Rec Stop initiative, which makes fresh produce available at specific recreation centers, adding that too many people don’t know about them. She lauded programs like the St. Pete Youth Farm, an urban project that creates a space to grow food, leaders, entrepreneurs and individuals while giving back to the community.

Peret said there is a consensus among residents that they should be able to make a living wage in the city they live and work in. Referencing a recent study that concluded St. Pete residents should earn about $94,000 a year to live a comfortable lifestyle, and knowing that the median income is around $50,000, that a large part of the city cannot afford to live comfortably.

He said residents should hold companies accountable for paying livable wages, and we should hold our elected officials accountable for the policies that they support.

Lavender said that the government plays a role in establishing workforce development programs and investment opportunities. It has the convening power to pull together the investment community inside of south St. Petersburg to look at opportunities per square mile to create more affordable storefront space. However, he said that discipline in managing your money is just as important.

He stressed knowing your credit score and working to make it higher because a mortgage is a qualifying transaction.

“It is not a charity. It isn’t benevolent. It’s qualifying,” explained Lavender. “So, at the end of the day, you must ask yourself that question going forward from today: can you bring more discipline to your life and more savings in your portfolio to qualify for a bigger piece of property?”

On the other end of the spectrum, Hardison said many people live paycheck to paycheck and can’t save because all their money goes to the essentials: food, shelter, and clothing.

“It is kind of hard to go to a financial literacy class, and they say, ‘Well, you’ve got to save. You’ve got to have something you can save.’ And then say, ‘Oh, well, you got to cut something out.’”

Hardison said the Black community needs more anchor institutions that don’t take money outside the community. Admittedly, this is hard to do when relying solely on corporate interests outside our community. She suggests forming more co-ops because they invest in the community.

“We need more institutions that are here and understand the everyday struggles we face,” she asserted.

Roberson brought up a stark fact that Black people nationwide own less property today than they did in the 1960s, citing her grandfather, who had an elementary school education and owned significant amounts of land and properties,

She said we must pass the knowledge down through the generations. She believes in buying it, keeping it and passing it. In passing it to the next generation, “there are certain guidelines that make a will enforceable,” she said, adding that consulting community law firms would be wise, as seeking legal guidance is crucial.

If that knowledge has not been passed down to you, Mallory suggests visiting the Neighborhood Home Solutions website at nhsfl.org and signing up for its financial literacy program. They offer several classes designed to help you make good financial decisions, whether that means helping you budget your money, buy your first home or avoid foreclosure.

Hardison, a former educator, said parents and community members have a responsibility to teach their children valuable lessons about financial literacy, home equity and banking. Although Pinellas County Schools will soon offer a one-credit financial literacy course as an elective, parents must make sure their children take the class.

CDAT’s Jabaar Edmond organized the Future of South St. Pete Economic Conference to inform residents of available resources.

“There are a lot of resources that, like we say, die on the vine, where the money will be sent back to the federal government or the grantee because they weren’t utilized. So, one of the main reasons we put this together is to start having conversations about the available resources.”

Most families have nothing left to invest after the bills are paid and food is purchased. Wages are too low. Washington is still at $7.25 an hour. Florida is at $12.00 an hour. Rent is $1800.00 for a one bedroom apartment in St. Pete. Over 10,000 + young folk have moved from St. Pete due to the rent issues. New units have a Luxury title. New homes are priced so high. Zillow and other realtors have purchased houses and are listing them for rent because no one can afford to purchase them.

We definitely need solutions, however, ‘regular’ people are being priced out of St. Pete. If you are not a professional making $40,000 and up, you are lost.